Ongoing N.Y. labor strikes hinge on employer benefit contribution

GINGER ADAMS OTIS

NEW YORK DAILY NEWS

Updated: Saturday, May 13, 2017, 3:51 PM

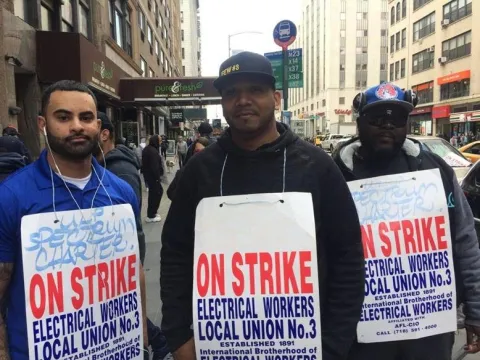

(From l.) IBEW Local 3 members Philip Sclafani, Jesus de la Cruz and Ayobami Ojedapo walk the picket line Friday outside Charter Communications' E. 23rd St. headquarters.

GINGER ADAMS OTIS

NEW YORK DAILY NEWS

Updated: Saturday, May 13, 2017, 3:51 PM

America's pension crisis is real — but not as bad as some companies want workers to believe.

Employer contributions to defined benefit plans — the Cadillac of retirement packages once common among workers — are at the center of two labor strikes playing out in New York right now.

The issue lurks in countless other contract negotiations across the state and country — with some employers looking to back-pedal their obligations while unions struggle to hold the line.

Catastrophic stories about tanking pension funds — like the demise of the Teamsters Local 707 trust — lend urgency to employers who want to cut their financial liabilities, according to Karen Ferguson, director of the Pension Rights Center.

FDNY EMT injured on job says bureaucracy is dashing pension hopes

Local 707 ran out of money after more than a decade of severe funding shortages, leaving its retirees trying to survive on a third of their promised pensions.

However, not all such plans —sustained by multiple employers across an industry who pay into a shared pot— are doomed. Yet every time an employer backs out —or goes bankrupt— the strain grows on those who remain, Ferguson noted.

“It is common to see companies all across the country trying to get out of multi-employer pension plans and bargain for 401(k) options for workers,” said Ferguson. “From a profitable employer's point of view, it’s a good deal for them. It’s also understandable. This is a hard place to be for a company and a hard place to be for a union.”

On Long Island, a third-generation family-run beer distributorship is going toe-to-toe with its employees and their union, Teamsters Local 812, over the pension.

Clare Rose wants to pull out of the Teamster’s fund, alleging that its “critical” status means the future retirement of employees is at risk.

“We believe the pension plan is failing and it’s not good for our workers in the long term,” Sean Rose, president of the company, told the Daily News in a recent interview.

“The math doesn’t add up... We don’t believe that it’s financially responsible to take care of our employees with a plan that doesn’t seem able to provide the benefits that it’s designed to provide. That’s the main reason we want to convert to a 401(k) plan,” said Rose.

Local 3 member Jesus de La Cruz poses with actor Matt Damon, who came to show solidarity.

Local 3 member Jesus de La Cruz poses with actor Matt Damon, who came to show solidarity.

(IBEW LOCAL 3)

Clare Rose pulling out of the pension fund — which costs them roughly $10,000 a year per employee — was the key issue that pushed its workers out on strike last month, the union said.

The company proposed replacing it with a 401(k) with no more than a $1200 per employee annual contribution from the company — although that could still be negotiated higher, Rose said.

The defined benefit plan of International Brotherhood of Electrician Workers Local 3 is also a major sticking point in its labor dispute with Charter Communications.

Some 1,700 field and cable techs with Charter — parent company of Spectrum-Time Warner Cable — walked off the job nearly seven weeks ago over contribution disagreements for its health and pension funds.

Charter said it had offered its techs a pay increase above what the union wanted and “competitive and robust health care and retirement benefits.”

The company said it felt it was “more beneficial to our employees than continuing to fund the failing union-managed benefits program.”

A spokesman reiterated the company’s position, but added it was willing to keep paying into the fund if necessary.

“We believe both plans are failing. Having said that... our current proposal does offer to contribute to the fund,” the spokesman said.

Neither the Teamsters Local 812 fund nor the IBEW Local 3 fund is technically failing —by the government definition of falling into a critical status that means it is severely underfunded.

According to 2016 financial documents provided by IBEW, its plan is 81% funded and on track to improve.

Picket line captain Rakim Smith (r.) and Norman Caban (l.) strike with Charter Communication workers.

Picket line captain Rakim Smith (r.) and Norman Caban (l.) strike with Charter Communication workers.

(GINGER ADAMS OTIS/NEW YORK DAILY NEWS)

“The plan was not in endangered, critical or with a declining status” in 2016, the annual funding notice said.

Local 812’s plan is forecast to grow from $350 million to $500 million over the next decade. It’s expected to be 100% funded by 2034, according to its latest federal filings.

More than 70% of the funds’ members are employed by Pepsi and Coca-Cola — and both companies recently signed five-year contracts pledging to remain.

The tricky part, for unions at least, is explaining to their members what it means when a fund enters critical status, said Ferguson, and trying to prevent a company from using that term as a reason to exit a fund.

“Being critical, or red-zoned, means the fund is required to undertake a rehabilitation plan to keep it solvent, going forward,” she said. “Usually employers have to put in a little more and certain benefits for those not yet retired are scaled back. You have to be in critical status to be able to take the necessary steps to save the plan,” she said.

Those that can’t pull themselves back from the brink are put in “critical and declining” status — and funds like those, such as the Central States Pension Fund, are in dire condition, Ferguson said.

But even in comparatively healthy funds like those of Local 812 and IBEW, many companies decide to get out while they can — even though it means paying a withdrawal liability.

“That leaves a lot of other companies holding the bag —even though the one pulling out still has to pay in to cover costs for its existing retirees,” Ferguson said. “But for a profitable company, it can make sense to pay the liability and then move employees into a 401(k). It’s certainly cheaper... but a 401(k) puts all the risk and all the responsibility on the worker.”

Recently in New York, another Teamster union, Local 813, narrowly avoided a decertification challenge at a Queens waste carting company where the owner wanted to get out from under his pension obligation.

Tom Tolentino, owner of Planet Waste in Maspeth, told The News in March his contract with Local 813 could “bankrupt” his company because of its underfunded pension plan — and that motivated his workers to consider moving to a new union that only offers 401ks. Local 813 submitted documentation showing its pension fund was 70% funded and growing — and in the end the National Labor Relations Board blocked Tolentino’s efforts to bust the union.